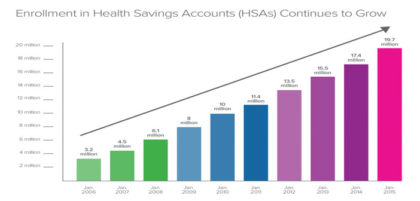

HSA Tips

HSA is an acronym for Health Savings Account. It describes a type of health insurance coverage where you use two products: a health insurance policy that has a high deductible and a savings account where you accumulate funds to pay for your medical expenses. The high deductible policies typically offer lower premiums than traditional policies with lower deductibles and copay benefits for doctor visits and prescriptions. The savings account provides tax savings similar to an IRA. Your contributions to the savings account are deductible on page 1 of your tax return. The combination of lower premiums plus tax savings has resulted in continued growth in HSAs. Many employers offer HSA plans to their employees or HSAs can be purchased by individuals.

19.7 million Americans were enrolled in HSA plans in January, 2015

Your savings account can be established at the financial institution of your choice. The amount and timing of contributions to the account are at your discretion. In fact, contributions for the previous tax year can be made up to the tax filing deadline. For most people, that means you can contribute to your 2015 HSA until April 15, 2016. Contributions are subject to annual limitations established by the IRS.

Tips

• If you have not made the maximum contribution for 2015, then add dollars to the account to get the most tax benefit.

• If you are 55 or older, you are entitled to an additional $1,000 contribution. If both you and your spouse are over 55 and are both covered by a high deductible health plan, you can both have an additional $1,000 contribution. However, each of you will have to have your own savings account to do this.

• You can reimburse yourself from the savings account for medical expenses that you may have paid personally throughout the year.

• Funds in the savings account can be used to pay medical expenses that are not otherwise reimbursed to you for any immediate family member. This includes family members that may be insured on a different policy. (You must be insured under a high deductible plan to be eligible to make a contribution to the savings account, but not to use the funds.)

• Dental and vision expenses may also be paid from your savings account. Use this link for a more complete list of Eligible Medical Expenses. http://www.hsacenter.com/qualified-med-expenses.html

• The balance remaining in your savings account at the end of the calendar year will roll over into the next year and continue to accumulate. There is no “use it or lose it” rule for an HSA.

by Chris McPike, Vice President

ComPro Insurance

402-488-5100 | www.comproins.com