Health Insurance and Taxes

January always means the beginning of tax season. Most people will receive a 1095 from their health insurance company, their employer, or the Health Insurance Marketplace. The form is similar to a 1099. It reports your eligibility and participation in health insurance plans for the previous year. The information on the 1095 is reported to the IRS and will be included in your personal tax return for 2017.

The 1095 serves two primary purposes. It is used to determine whether you had “qualifying coverage” in a health insurance plan for 2017. That information is the basis for whether you must pay a penalty for not having insurance. This “individual mandate penalty” may be eliminated for future years, but remains a part of the tax code for 2017.

For those who used the Health Insurance Marketplace to enroll in an individual or family health insurance plan, the 1095 reports the dollar amount of Premium Tax Credit that you received in 2017. This is part of the calculation to determine if you are due a refund or may have to reimburse some of the Premium Tax Credit.

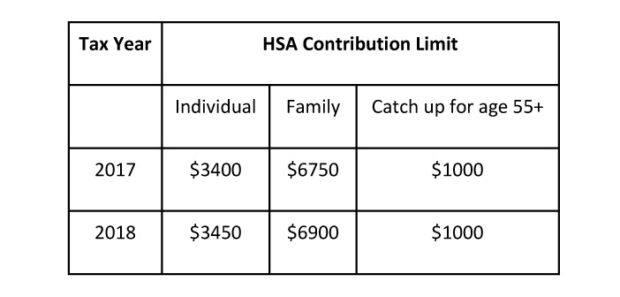

HSA accounts can be funded until April 15th and be used as a deduction for 2017. If you have not fully funded your HSA account yet, this is a great way to lower your taxable income AND set aside some money to pay for future medical, dental, or vision expenses.

ComPro…..Health Insurance Simplified

Make an educated decision, visit ComProIns.com today.

402-488-5100 | 1040 N. Cotner, Lincoln NE